A Cross of Gold: Why Fiat Money is Here to Stay

by Angela Su

- Original infographic by DPR Graphic Design Editor Betty Zhou

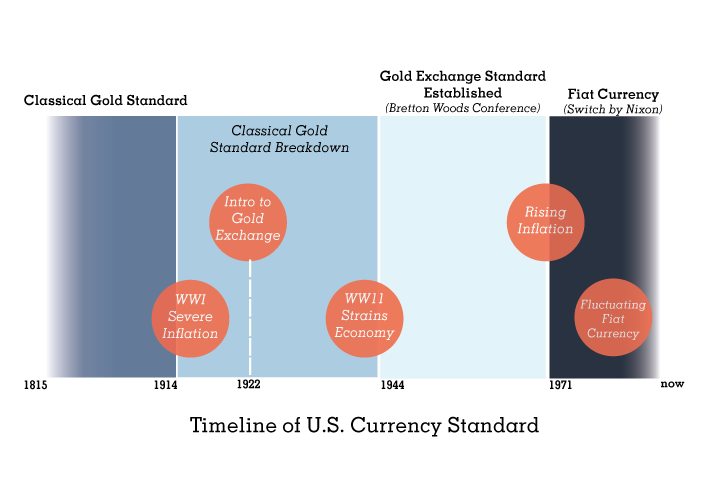

Last Wednesday, during the nationally televised Republican presidential debate, Sen. Ted Cruz criticized the Federal Reserve for its supposedly unregulated mishandling of American currency, as well as its interest rate. Cruz proposed reverting U.S. monetary policy to a gold standard, which effectively came to an end in the 1930s, strained by the inflationary chaos arising from World War I.

In 1944, the Bretton Woods Agreement established an international gold exchange standard (a less stringent adaptation of the gold standard). This allowed for more flexibility in international currency valuations, which were then tied to the U.S. dollar rather than gold. The U.S. dollar became the international reserve currency, the value of which was linked to the price of gold at a fixed conversion rate of $35 per ounce. The U.S. dollar was considered virtually as stable as gold, considering the strength of the U.S. economy and the U.S. government’s commitment to maintaining the dollar’s fixed conversion rate to gold. On top of that, the dollar could earn interest and was more flexible than gold.

The period of international monetary policy from 1880 to 1914 -- cut off by World War I -- was ruled by the classical gold standard, in which all domestic currencies were directly tied to gold at a specific conversion rate. The benefits of an international gold standard can be seen in this period: it checked the potential of currency inflation by governments and balanced the rates of imports and exports through the measurements of a country’s deficits or surpluses in gold, rather than through possibly overinflated or deflated national currency. This allowed for a period of unprecedented economic growth with abundant free trade, investment, and travel, facilitating the implementation of specialization and international labor division.

Cruz and other supporters of reverting to a gold standard argue that, in a time of economic volatility, tying the U.S. currency to gold would create economic stability and prevent the government from damaging the economy by inflating the currency through a rapidly increasing supply of paper currency. However, advocates of this outdated economic policy fail to comprehensively address the numerous disadvantages of the gold standard in terms of economic multilateralism, disadvantages that caused countries to release their currencies from the strict gold conversion rates after World War I. The issue with an international gold standard is that it cripples policymakers in their abilities to adjust currency valuations, trade, and multilateralism in response to national and global crises, as well as their fiscal effects. This was the case in the 1930s, when the resource-draining World War II exacerbated existing monetary chaos through stunted trade and competitive devaluations, and again in the 1970s, when untempered inflation in the United States and a decreasing international confidence in the strength and stability of the dollar pushed former President Richard Nixon to finally abolish the last remnants of the gold exchange standard.

When Nixon ascended to the presidency, the United States was facing economic pressures from a looming international exchange crisis. As inflation and unemployment rates rose and the dollar’s international value dropped, more and more countries released their currencies from the Bretton Woods Agreement. Those that remained demanded compensation in gold for the decreasing values of their reserves of dollars. After a secret meeting at Camp David with several advisers, Nixon suspended the gold conversion rate from dollars and froze the inflation rate for 90 days, marking the U.S. economy’s switch to fiat currency and essentially terminating the world’s last link to the centuries-old gold standard.

The big advantage of in the fluctuating fiat currencies that govern international exchange rates today is that they allow the U.S. market to self-regulate the international valuation of the dollar. This essentially frees policymakers from having to focus on dollar surpluses and balance of payments, instead allowing them the flexibility to adapt economic policy to exchange fluctuations. Since the switch to fiat currency, the unemployment rate has generally risen, and the United States has been freed from the large resource cost of producing gold, in favor of the much cheaper production costs of the printing press. The U.S. dollar remains a central standard in international exchange rates. Although the international economy has suffered setbacks from a continued depreciation of the U.S. dollar, returning to the gold standard would, in the words of Nobel Prize-winning economist Paul Krugman, be an “almost comically bad idea,” as, apart from the fact that the enormous U.S. deficit of $18 trillion would be extraordinarily difficult to link to the supply of gold, it would mean a return to extreme economic short-term instability, long, unrestrained patterns of inflation, and the inflexibility of the U.S. economy to respond effectively to these crises.